A bankruptcy information services web-based platform that reduces risk and improves outcomes throughout the bankruptcy lifecycle.

See Epiq AACER® in action. Get answers to your questions and find out why Epiq AACER® is the right choice for your business.

Most Complete, Accurate and Timely Bankruptcy Dataset

- AACER® and MY AACER®, both web-based platforms, store millions of cases which include every electronically filed bankruptcy case.

- Leverage a wide variety of scrub services to identify bankruptcies within a newly acquired or planned loan portfolio acquisition, data audits, true-ups, remediations and more.

- Make more informed decisions, validate data accuracy in your servicing system, and identify compliance or quality control issues.

Automatically Match New Bankruptcy Filings Against Your Customer List

- AACER®'s Filer Match & Notify automatically matches and notifies the new daily case filings across all secured and unsecured asset types; including mortgages, vehicles, real estate, equipment, credit cards, education, Paycheck Protection Program (PPP) and more.

- Eliminate the risk of missing new filings and potential associated fines.

- Reduce manual time associated with identifying and on-boarding new bankruptcy filings.

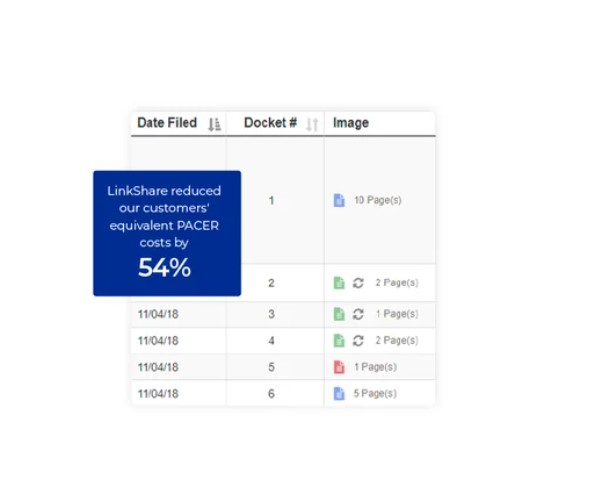

PACER Alternative for Case Search and Document Retrieval

- AACER®'s Data Search & Retrieval, in conjunction with MY AACER®, enables an easier and faster user experience for searching bankruptcy cases and their associated filed court documents.

- Simplify the case search workflow to one-step, enable fast access to dockets, claims, creditor matrix and more with tabbed query-function, store documents for reuse by anyone within your organization at no additional charge, and eliminate costs associated with managing a repository in-house

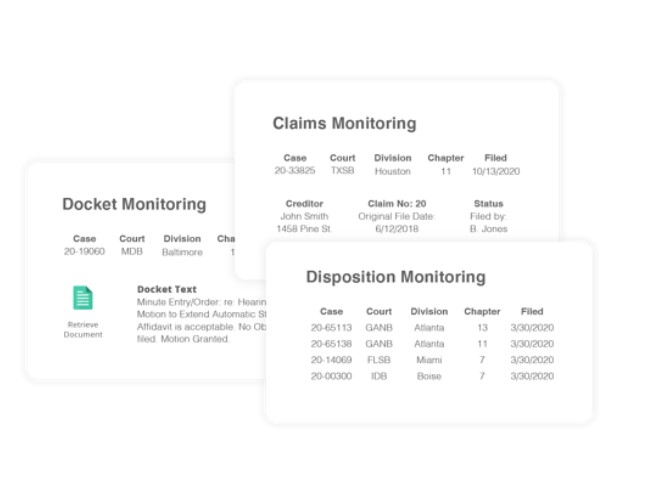

Automatically Monitor and Identify Bankruptcy Case Changes

- AACER®'s Docket & Claims Monitoring automates daily docket and claims case changes to improve outcomes for secured and unsecured portfolios. AACER®'s Disposition Monitoring automates daily disposition monitoring to identify closed, dispositioned, dismissed and other dates.

- Prevent missing case events, such as responding to a Notice of Final Cure Payment, with workflows that automatically assign work within queues and save time managing deadlines through work queues that organize and prioritize daily tasks

Automatically Match Payments from the NDC to Your Loan Portfolio

- AACER®’s Cashiering obtains Trustee payment disbursement details from the National Data Center (NDC) and matches results to your loan portfolio.

- Reduce risk and associated costs with the misapplication of payments.

API Access for Data Retrieval

- AACER®APIs allow seamless retrieval and transmission of real-time bankruptcy case information directly into your system of record.

- Improves speed to electronically update current bankruptcy information directly into your servicing system.

- Ensures case data in your system is current and accurate.