A bankruptcy information services web-based platform that reduces risk and improves outcomes throughout the bankruptcy lifecycle.

See Epiq AACER® in action. Get answers to your questions and find out why Epiq AACER® is the right choice for your business.

Most Complete, Accurate and Timely Bankruptcy Dataset

AACER® and MY AACER®, both web-based platforms, store millions of cases which include every electronically filed bankruptcy case. The volume grows daily as it sweeps the courts nightly for new filings and updates. Leverage a wide variety of scrub services to identify bankruptcies within a newly acquired or planned loan portfolio acquisition, data audits, true-ups, remediations and more.

- Make more informed decisions

- Validate data accuracy in your servicing system

- Identify compliance or quality control issues

Automatically Match New Bankruptcy Filings Against Your Customer List

AACER®'s Filer Match & Notify automatically matches and notifies the new daily case filings across all secured and unsecured asset types; including mortgages, vehicles, real estate, equipment, credit cards, education, Paycheck Protection Program (PPP) and more.

- Eliminate the risk of missing new filings and potential associated fines

- Reduce manual time associated with identifying and on-boarding new bankruptcy filings

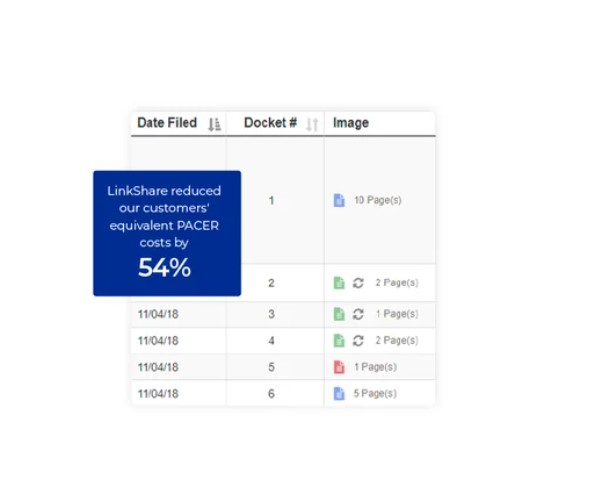

PACER Alternative for Case Search and Document Retrieval

AACER®'s Data Search & Retrieval, in conjunction with MY AACER®, enables an easier and faster user experience for searching bankruptcy cases and their associated filed court documents.

- Simplify the case search workflow to one-step

- Enable fast access to dockets, claims, creditor matrix and more with tabbed query-function

- Store documents for reuse by anyone within your organization at no additional charge

- Eliminate costs associated with managing a repository in-house

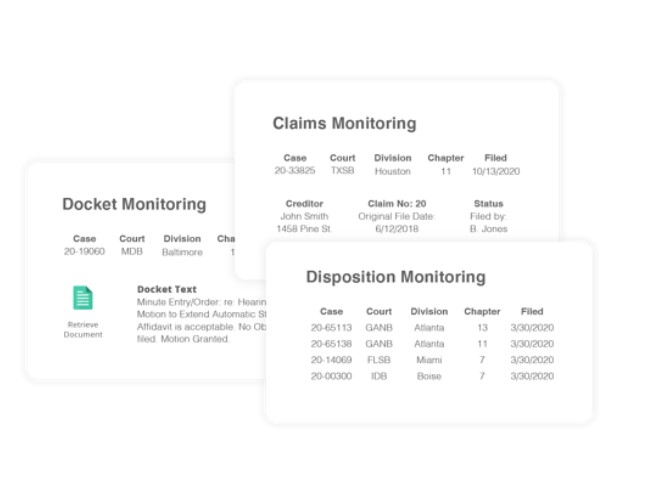

Automatically Monitor and Identify Bankruptcy Case Changes

AACER®'s Docket & Claims Monitoring automates daily docket and claims case changes to improve outcomes for secured and unsecured portfolios. AACER®'s Disposition Monitoring automates daily disposition monitoring to identify closed, dispositioned, dismissed and other dates.

- Prevent missing case events, such as responding to a Notice of Final Cure Payment, with workflows that automatically assign work within queues

- Save time managing deadlines through work queues that organize and prioritize daily tasks

Automatically Match Payments from the NDC to Your Loan Portfolio

AACER®’s Cashiering obtains Trustee payment disbursement details from the National Data Center (NDC) and matches results to your loan portfolio.

- Reduce risk and associated costs with the misapplication of payments

Integrate Bankruptcy Data into Servicing Systems

AACER® APIs allow seamless retrieval and transmission of real-time bankruptcy case information directly into your system of record.

- Improves speed to electronically update current bankruptcy information directly into your servicing system

- Ensures case data in your system is current and accurate